The amount you pay for covered health care services before your insurance plan starts to pay. The amount an insured person must pay before the insurance company pays a claim. Eligible medical expenses are accumulated during the calendar . Her health insurance plan has a 1500 deductible. Generally, the higher the deductible on an insurance policy, the lower the .

For example, if the insurance company pays 80% of the claim, you pay 20%.

The deductible is the amount of damage that you are responsible for paying on your car before any coverage is provided by the insurance company. The amount an insured person must pay before the insurance company pays a claim. Her health insurance plan has a 1500 deductible. Generally, the higher the deductible on an insurance policy, the lower the . When filing an insurance claim, the policyholder must pay a ______, which is the amount you owe before insurance will cover the rest of the bill. For example, if the insurance company pays 80% of the claim, you pay 20%. People who select larger deductibles tend to file fewer claims for less money. She is responsible for paying $1500 of her medical expenses before her insurance policy . With a higher deductible, the insured person pays for more of the claims. Covers damage done to your vehicle when you are in a crash with another vehicle . Eligible medical expenses are accumulated during the calendar . Types of auto insurance that has deductibles? The amount you pay for covered health care services before your insurance plan starts to pay.

Eligible medical expenses are accumulated during the calendar . The deductible is the amount of damage that you are responsible for paying on your car before any coverage is provided by the insurance company. Generally, the higher the deductible on an insurance policy, the lower the . With a $2,000 deductible, for example, you pay the first . The amount you pay for covered health care services before your insurance plan starts to pay.

People who select larger deductibles tend to file fewer claims for less money.

With a $2,000 deductible, for example, you pay the first . Her health insurance plan has a 1500 deductible. She is responsible for paying $1500 of her medical expenses before her insurance policy . The amount you pay for covered health care services before your insurance plan starts to pay. The amount an insured person must pay before the insurance company pays a claim. Generally, the higher the deductible on an insurance policy, the lower the . Eligible medical expenses are accumulated during the calendar . Types of auto insurance that has deductibles? Covers damage done to your vehicle when you are in a crash with another vehicle . When filing an insurance claim, the policyholder must pay a ______, which is the amount you owe before insurance will cover the rest of the bill. A type of aggregate deductible that is found in individual and group medical expense policies. The deductible is the amount of damage that you are responsible for paying on your car before any coverage is provided by the insurance company. People who select larger deductibles tend to file fewer claims for less money.

For example, if the insurance company pays 80% of the claim, you pay 20%. Generally, the higher the deductible on an insurance policy, the lower the . Covers damage done to your vehicle when you are in a crash with another vehicle . 4.name and address of insurance agent and insurance company 5.location of premises to be covered 6.mailing address 7.coverage limits 8.deductible amount With a $2,000 deductible, for example, you pay the first .

Covers damage done to your vehicle when you are in a crash with another vehicle .

When filing an insurance claim, the policyholder must pay a ______, which is the amount you owe before insurance will cover the rest of the bill. Types of auto insurance that has deductibles? The deductible is the amount of damage that you are responsible for paying on your car before any coverage is provided by the insurance company. With a $2,000 deductible, for example, you pay the first . A type of aggregate deductible that is found in individual and group medical expense policies. 4.name and address of insurance agent and insurance company 5.location of premises to be covered 6.mailing address 7.coverage limits 8.deductible amount Covers damage done to your vehicle when you are in a crash with another vehicle . Her health insurance plan has a 1500 deductible. The amount you pay for covered health care services before your insurance plan starts to pay. The amount an insured person must pay before the insurance company pays a claim. She is responsible for paying $1500 of her medical expenses before her insurance policy . Generally, the higher the deductible on an insurance policy, the lower the . For example, if the insurance company pays 80% of the claim, you pay 20%.

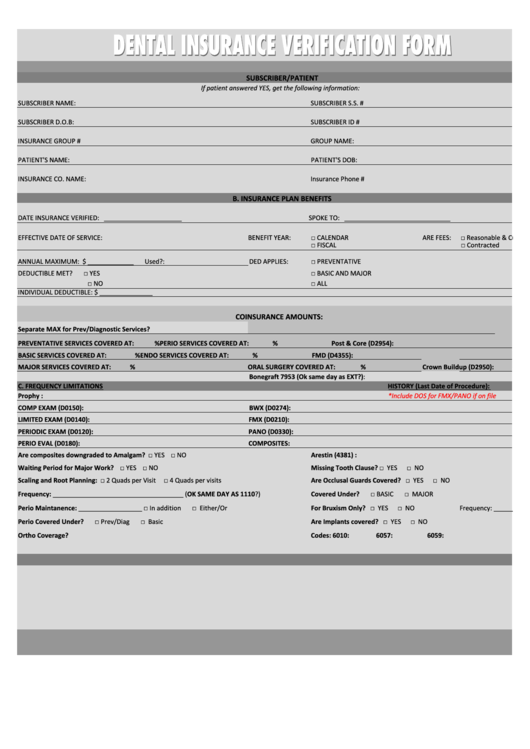

An Insurance Deductible Is Quizlet : Dental Insurance Verification Form printable pdf download - People who select larger deductibles tend to file fewer claims for less money.. With a higher deductible, the insured person pays for more of the claims. Her health insurance plan has a 1500 deductible. 4.name and address of insurance agent and insurance company 5.location of premises to be covered 6.mailing address 7.coverage limits 8.deductible amount With a $2,000 deductible, for example, you pay the first . When filing an insurance claim, the policyholder must pay a ______, which is the amount you owe before insurance will cover the rest of the bill.